Financial Literacy Course

Overview

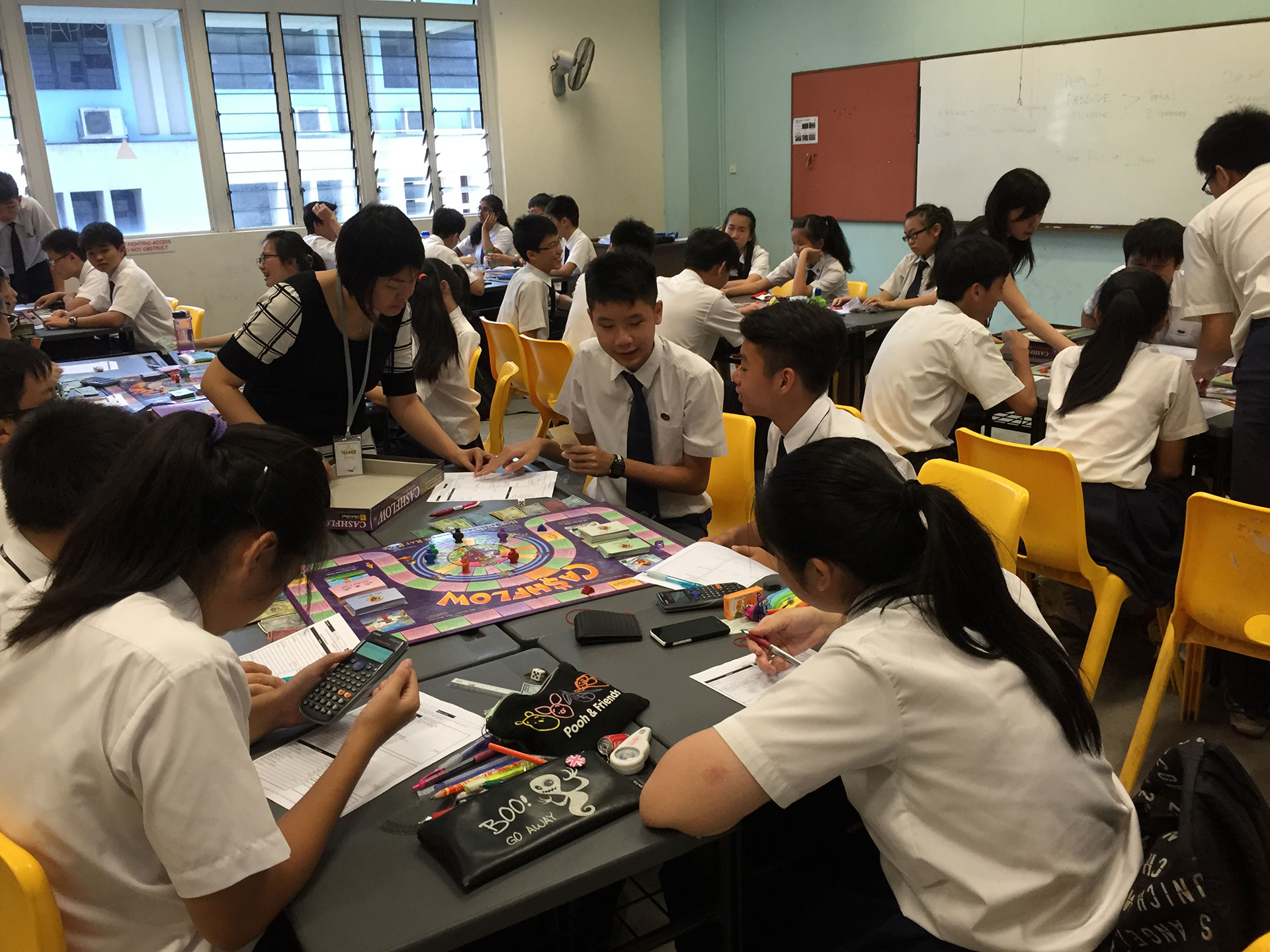

Our Financial Literacy workshops aim to equip the participants with the knowledge and understanding on the importance of managing their finances and the steps they should take to be financially literate.

Who Should Attend

Our Financial Literacy Course has been planned according to 3 groups of participants, namely Kids, Teens and Adults. The Kids workshop is targeted at Primary School students between the ages of 9-12, while the Teens workshop aims to reach out to Secondary School and Junior College students. Our Adults workshop is designed for the benefit of students from Institutes of Higher Learning and working adults.

Syllabus

Our syllabus can be customised according to the age group of our participants. This ensures that the content would be relevant and applicable to their needs. Click on the respective tabs to find out more

Financial Management for Adults

Our Financial Literacy for Adults course aims to equip the participants with Financial Literacy and management knowledge and skill sets. The course is highly customisable to the requirements of the client.

Some of the common modules include:

- Cash-Debt Management

- Personal Life Cycle and Finances

- Investment Instruments (Bonds, Property etc.)

- Equities and Stock Trading

- Comprehensive Financial Management

We also provide training for various specialised areas of Financial Literacy. The areas of specialisation can be included based on the requirements of the client. We have listed the areas of specialisation that are commonly requested:

- Time Value of Money

- Managing your CPF

- Retirement Planning

- Risk Management

- Reading Financial Statements

Financial Management for Teen

- “Secrets of the RICH”

- The Origin of Money

- Types of Money

- Importance of Financial Literacy

- Cash-Debt Management

- Needs vs. Wants

- Budgeting

- Types of Loans

- Credit Cards Problems

- Bankruptcy

- Investment Instruments

- Deposits

- Shares

- Unit Trusts

- Property

- Risk Management

- Risk Profiling

- Calculating Risk

- Insurance

- Basic Terminology

- Life

- General Insurance

- Fundamental Analysis

- Macro Economics

- Industry Overview

- Company Financial Ratios

- Time Value of Money

- Importance of Time Value of Money

- Calculating Present Value & Future Value

- Bullet Cash Flow and Cash Flow Stream

- Data Analytics

- Descriptive vs. Predictive

- Economics and Financial Modelling (Basic)

- Life Time Value of a Customer

- Corporate Visits

- Speaker Series

Delivery Modes:

- Verbal Elaboration

- Interactive Games

- Case Studies

- Scenario-based Learning

Financial Management for Kids

- What is Money?

- Forms of Money

- History of Money

- What can you do with Money?

- Price for Goods and Services

- How do we earn Money?

- Savings and Deposits

- Importance of Savings

- Steps to Savings

- How to start a Savings Account

- Needs vs. Wants

- What are Needs and Wants?

- How do we deal with Wants?

- Budgeting

- What is a Budget?

- How to use a Budget?

Delivery Modes:

- Verbal Elaboration

- Interactive Games

- Hands-on Activity

- Skit/Storytelling

- Reflection